Apr compounded monthly

Annual Percentage Yield - APY. We know this beforehand because mortgages are.

Compound Interest Calculator Daily Monthly Quarterly Annual

However in most loan situations it is compounded monthly.

. By calculating APY you can see that the first exemplary offer pays the most. For example if your mortgage compounds interest monthly it would be compounded 12 times in a year. 00083 x 100 083.

The longer the amortization period the smaller the monthly payments will be but the more the loan will cost in total. APR typical APR advanced Resources. Amount that you plan to add to the principal every month or a negative number for the amount that you plan to withdraw every month.

Using our compounding formula we can calculate the effective APR to be 304 or. APY can sometimes be called EAPR meaning effective annual percentage rate or EAR referring to the effective annual rate. No MT fee at other banks ATMs.

Thus at the equivalent rate APR appears lower than the APY assuming positive rates. The traditional period for amortization of a mortgage the time to pay it off is 25 years. The main difference between APY and APR is that the former considers yearly compounded interest while APR always means a monthly period.

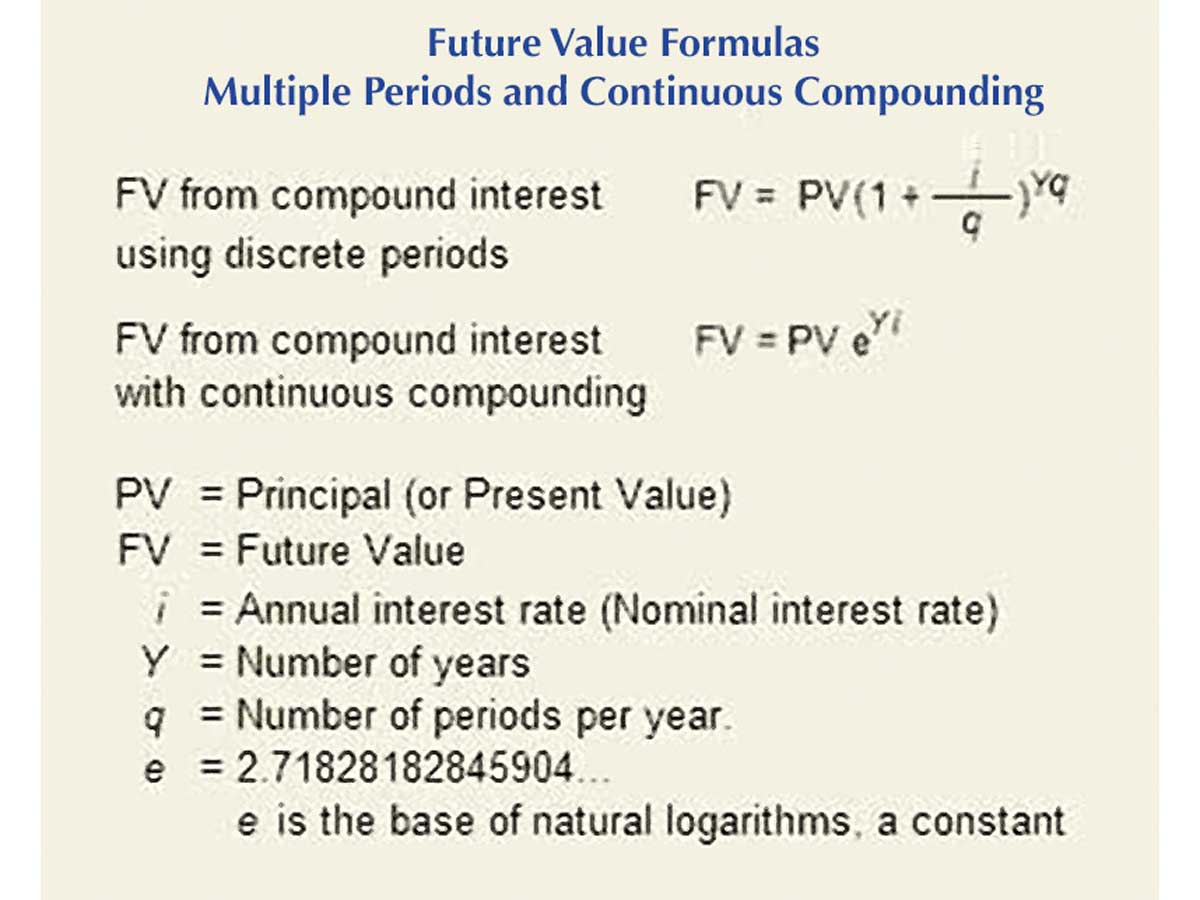

Interest rate of 05 compounded daily APY 0501. R interest rate n number of compounding periods if interest is compounded monthly this would be 12. How do you calculate monthly APR.

2500 Minimum Balance Required to Earn Stated APY and to Avoid Maintenance Fee. Interest Rate The annual interest rate or stated rate on the loan. Calculating your monthly APR begins by calculating your total APR.

Length of Time in Years. Get 247 customer support help when you place a homework help service order with us. To find our monthly APR simply divide your total APR by.

Mortgages dont do that because the total amount of interest due is already calculated beforehand and can be displayed via an mortgage amortization schedule. Interest rate of 07 compounded quarterly APY 0702. Option for interest-bearing or non-interest-bearing 2.

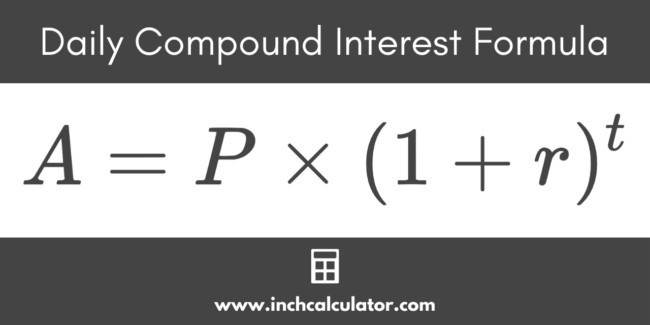

The first part of the equation calculates compounded monthly interest. Compound interest or compounding interest is interest calculated on the initial principal and also on the accumulated interest of previous periods of a deposit or loan. See the Basic APR Calculator for simple APR calculations.

APY is calculated by. In this calculator the monthly payment is calculated by the following formula where r R1200. Multiply the result from step 4 by 100 to convert the monthly rate from a decimal to a percentage.

We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply. Those terms have formal legal definitions in. But this is done in periods of five years at a time though it is possible to pay the mortgage down in a shorter period just not longer.

A simple equally-weighted average return of all Zacks Rank stocks is calculated to determine the monthly return. Lets say that you buy a one-year CD with a 3 annual interest rate compounded monthly 025 per month. Is always a yearly figure.

EPA expects all products on List N to kill the coronavirus SARS-CoV-2 COVID-19 when used according to the label directions. The term annual percentage rate of charge APR corresponding sometimes to a nominal APR and sometimes to an effective APR EAPR is the interest rate for a whole year annualized rather than just a monthly feerate as applied on a loan mortgage loan credit card etcIt is a finance charge expressed as an annual rate. Finishing the example you would multiply 100 by 0001978332 to find the monthly interest rate to be 01978332 percent.

For example a 300000 mortgage set at 4 on a 30-year fixed mortgage will have total interest due of 215610 over the life of the loan. Times per year that interest will be compounded. Interest rate of 1 compounded yearly APY 1.

The monthly returns are then compounded to arrive at the annual return. The APY for a 1 rate of interest compounded monthly would be 1268 1 00112 1 1268 a year. If you only carry a balance on your credit card for one months period you will be.

Now the only thing you have to remember is that the higher the APY value is the better the offer. We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply. APY or annual percentage yield is different from APR or annual percentage rate.

Enjoy ATM surcharge rebates 34 and earn interest 2. Also the monthly rate yields an interest of 83 which is slightly higher than the interest produced by quarterly rates at 8240. Get 247 customer support help when you place a homework help service order with us.

The second part of the equation calculates simple interest on any additional days beyond the number of months. For instance if your interest is compounded as is the case for long-term loans such as mortgages and student loans calculating APR will not be specific. Daily compounding yields a higher interest of 8360 which is slightly higher than the interest at monthly rates of 8260.

For example if the amount owed is 1500 the payment due date is April 1 the agency does not pay until June 15 and the applicable interest rate is 6 interest. Waive the 1495 monthly maintenance charge for each monthly service charge cycle 1 with. How-to in-depth technical articles for machine design engineers.

In your compound interest formula this value is represented by an n In the case of an investment interest would be compounded until the end of the deposit term or until you withdrew your investment. The APR includes fees in. Thought to have.

Your monthly interest rate is 083. Direct deposits of 1500 or more per monthly service charge cycle-OR-2500 or more average daily balance in this account. Convert the monthly rate in decimal format back to a percentage by multiplying by 100.

A flexible high-yield account with a competitive rate that gets compounded and paid monthly to build savings quickly. Loan Amount The original principal on a new loan or remaining principal on a current loan. Your APR refers to one year.

The annual percentage yield APY is the effective annual rate of return taking into account the effect of compounding interest. Plus Certificate of Deposit Rate. Now divide that number by 12 to get the monthly interest rate in decimal form.

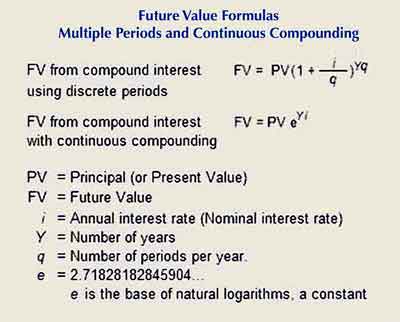

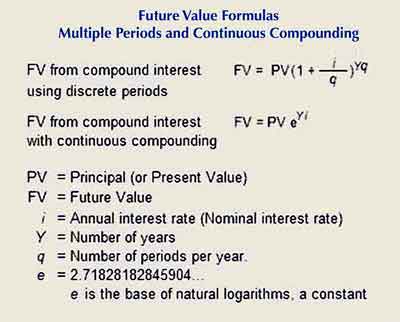

Mathematics Of Compounding Accountingcoach

Time Value Of Money Board Of Equalization

How Can I Calculate Compounding Interest On A Loan In Excel

Answered You Have Just Sold Your House For Mortgage Payoff Selling Your House Payoff

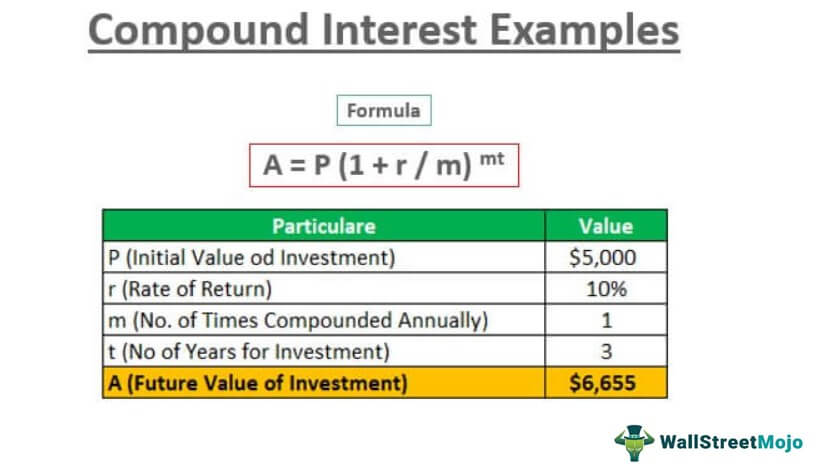

Compound Interest Examples Annually Monthly Quarterly

Compound Interest Definition Formula How It S Calculated

Continuous Compounding Formula Derivation Examples

What Is Monthly Compound Interest Formula Examples

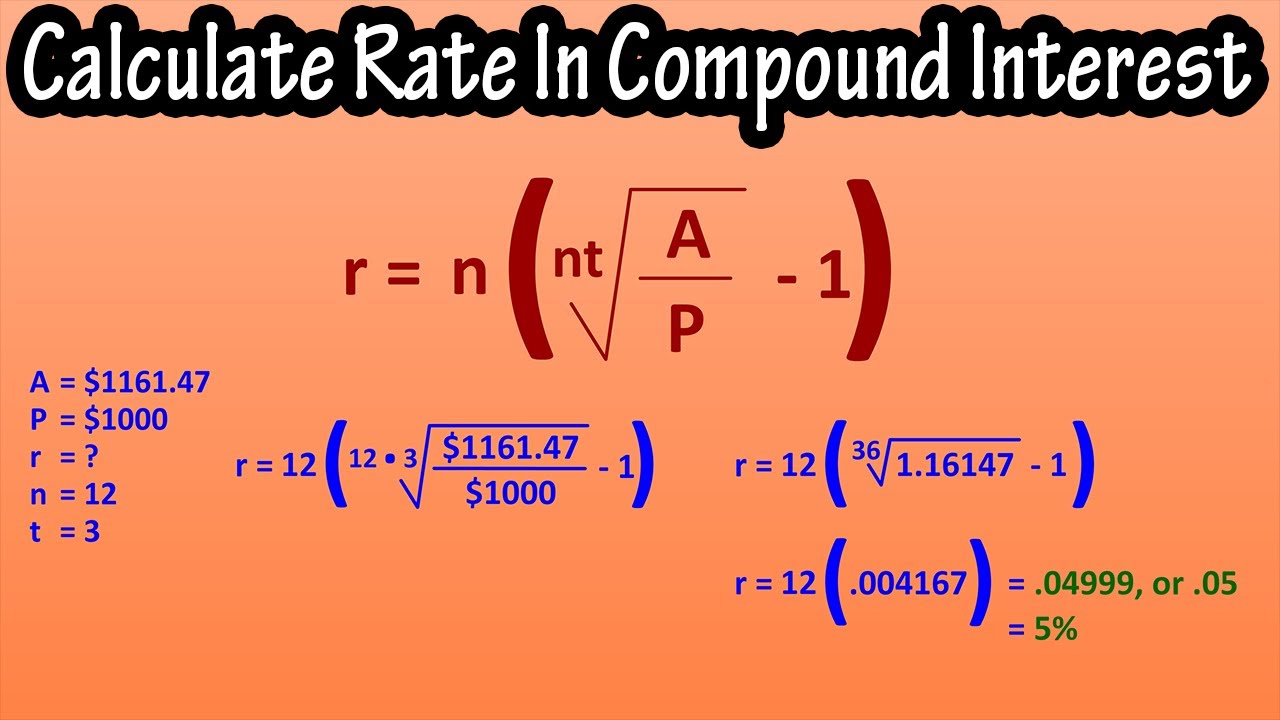

How To Solve For Or Calculate Rate In Compound Interest Formula For Rate In Compound Interest Youtube

How To Calculate Interest Compounding For Exponential Growth

Compound Interest Formula Explained Investment Monthly Continuously Word Problems Algebra Youtube

Dp Maths Compound Interest 10 Apr 17 Subscribe Us Www Youtube Com C Mahendraguruvideos Join Us Facebook Math Study Materials Compound Interest

2

Openalgebra Com Interest Problems

How To Calculate Interest Compounding For Exponential Growth

:max_bytes(150000):strip_icc()/COMPOUNDINTERESTFINALJPEGcopy-f248781269194135aa6044e088de7af9.jpg)

Compound Interest Explained With Calculations And Examples

Daily Compound Interest Calculator Inch Calculator